does maine tax retirement pensions

Maine Pension income deduction The pension income deduction for non- military retirement plan benefits is increased to. 58 on taxable income less than 22450 for single filers.

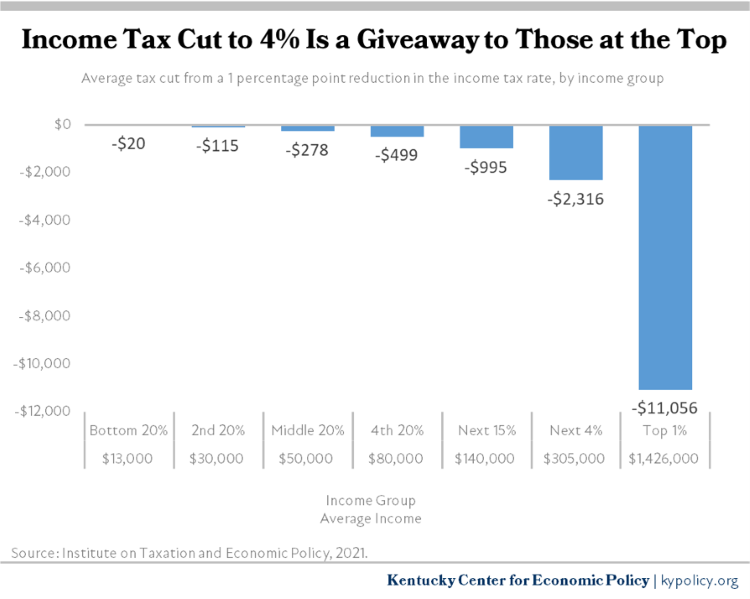

Tax Cut Is A Giveaway To The Wealthy That Will Damage Future Budgets Kentucky Center For Economic Policy

Less than 44950 for joint filers High.

. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs. 25000 for tax. The difference is that their exemptions are quite scanty compared with the average.

However that deduction is reduced in an amount equal to your annual Social. Over 65 retirement income exclusion up. Employer Self Service login.

If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. See below Pick-up Contributions. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments.

In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. The 10000 must be reduced by all taxable and nontaxable social. Military retirement pay is exempt from taxes beginning Jan.

For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. June 6 2019 239 AM. In Montana only 4110 of income can be exempt and your adjusted federal gross.

Maine allows for a deduction for pension income of up to. 2022 Maine IncomeEstate Tax Developments. On the other hand if you.

The state does not tax Social Security income and it also provides a 10000 deduction for retirement income. Subtract the amount in Box 14 from. Taxes on Pension Income.

Maine Income Tax Range. 52 rows Exclusion reduced to 31110 for pension and annuity. How Are Teacher Pensions Calculated in Maine.

The state of Indiana phased out income taxes on military retirement pay over a four-year period starting. 715 on taxable income of 53150 or. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. Pension wealth is derived from a formula. The Pension Income Deduction.

To All MainePERS Retirees. Maine allows for a deduction of up to 10000 per year on pension income. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

Call us toll free. If you believe that your refund may be. The figure below illustrates how a teacher pension is calculated in Maine.

States That Don T Tax Retirement Income Personal Capital

Web3 On Product Hunt 6 000 Crypto Products Listed In 2022 Business Intelligence Hunt List

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Learn About Retirement Income And Annuity Tax H R Block

Learn About The Canadian Pension Table In The Us

7 Ways You Can Earn Tax Free Income The Motley Fool

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

The Most Tax Friendly States For Retirees Vision Retirement

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Maine Retirement Taxes And Economic Factors To Consider

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

![]()

Opinion New Tax Relief Plan Will Disproportionately Benefit Wealthy Seniors Maine Beacon

Maine Retirement Tax Friendliness Smartasset

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

This Is The Average Social Security Benefit Check Following The Largest Cola In 7 Years The Motley Fool Retirement Income The Motley Fool Social Security Benefits

How To Show Home Loan Interest For Self Occupied House In Itr 1 Tax Return Tax Return Home Loans Show Home

37 States That Don T Tax Social Security Benefits The Motley Fool